Learn about the winery business and find information on how to open a winery. Don’t forget you can receive free or low-cost training and free professional business advice, from your local Small Business Development Center!

View our related business reports here: Brewery Business, Distillery Business, Wine Bar Business and Beverage Industry Research.

Get a free Winery business plan template on our Business Plans page.

Winery COVID-19 Resources

In response to the global COVID-19 pandemic, shelter-in-place orders and physical distancing measures have affected many businesses. Here is a look at the impact to the winery industry. Wineries have experienced a decline in sales as government public health regulations and stay at home orders have restricted operations such as tasting rooms, in-person events, and on-premise sales. Moreover, operators that rely heavily on wholesale sales to food service and accommodation establishments experience loss as these businesses have temporarily closed or limited their operations. In effort to adapt to changing conditions, many wineries have increased their direct-to-consumer sales. Consumer demand remains high as households are drinking more alcohol while contained in their homes. As states begin to reopen, consumers are cautious about reentering public spaces, meaning that distribution for wine businesses may experience a lasting change.

- SBDCNet COVID-19 Small Business Resources

- Wine Institute Coronavirus (COVID-19) Resources

- TTB Updates and Guidance on COVID-19

- Wine America Covid-19 Resources

- COVID-19: Tips for Your Winery

- Covid-19 presents opportunities for the US wine market

Winery Business Overview & Trends

NAICS Code: 312130, SIC Code: 2084

Wineries are a key segment of the U.S. alcohol industry producing over 409 million cases worth more than $72 billion in 2019, according to the market research firm bw166 cited by the Wine Analytics Report. Statistics from Wine America show that California produces 85% of all U.S. wine and is the state with the most number of the 10,043 wineries in the U.S.

This wineries industry summary is from First Research which also sells a full version of this report.

- “Companies in this industry make wine and brandies either from grapes that they grow or that are grown elsewhere. Major companies include Bronco Wine, Constellation Brands, E&J Gallo, Jackson Family Wines, and The Wine Group (all based in the US); as well as Distell Group (South Africa), Gruppo Italiano Vini (Italy), Treasury Wine Estates (Australia), Veuve Clicquot (France), and Viña Concha y Toro (Chile).

- Total worldwide wine production is about 250 to 300 million hectoliters per year, according to the International Organization of Vine and Wine. Major wine-producing countries include Italy, France, Spain, the US, and Argentina. The US is the world’s largest wine consuming country by volume, but emerging economies in Asia, Africa, and South America may offer opportunities for future industry growth. Consumption is flat or declining in most mature European markets, although growth worldwide overall has slowed due to recent declines in consumption in China and the UK. The US winery industry includes about 12,500 producers with combined annual revenue of about $22 billion.

- Competitive Landscape: Demand for wine is driven by the restaurant and hotel industries, the level of business entertainment spending, and consumer income. A winery’s profitability depends on production volume and sales price, both of which can vary from year to year. Large companies have stronger distribution channels and can enjoy significant economies of scale in production.

This Wine in the US market research report summary is from Euromonitor, which also sells a full version of this report.

- Most wines struggled to compete with the rising popularity of hard seltzer beverages beloved for their simplicity (especially among millennials), contributing to a year of modest to stagnant sales volume growth in 2019.

- With the economy in recession, consumers are expected to lean heavily towards purchasing wines based on perceived best value rather than brand-loyalty, creating a favorable environment for private label wines.

- The sparkling wine and champagne category has the best forecasted growth rate, although all wine types will experience overall sales declines in 2020 as a result of COVID-19 impacts.

Wine Customer Demographics

Major customer segments for wineries are reported by IBISWorld, which offers full versions of the report for purchase here.

- Wineries generate approximately $26.1 billion in industry revenue in 2020, with key market segmentation defined by the distribution channel.

- The key markets for wineries consist of retailers (45.2%), wholesalers (39.6%), food service providers (9.9%), and exports (5.3%).

- Retailers, including supermarkets, grocery stores, convenience stores, and stand-alone liquor stores, represent almost half of the winery industry’s total sales. Retail sales vary by state due to state laws restricting alcohol sales.

- Restaurants, hotels, caterers, and other food service providers make up the food service market. These establishments purchase wine in bulk on a regular basis for on-premise sales.

- Declining regulations have contributed to a recent uptick in direct shipments retailers, restaurants, and food service providers foregoing wholesalers as well as to consumers via increase in online sales.

- S. wines, of which a majority are produced in California, have been globally embraced. Exports make up the smallest market for wineries, and the value of exports to foreign consumers is expected to decline over the next five years due to the rise in value of the U.S. dollar.

Additional information on wine consumers can be found in a variety of additional resources and publications, including:

- U.S. Wine Consumption

- Consumer Trends Present Opportunities for the Wine Industry

- Wine Intelligence: U.S. Consumer Segmentation

- State of the Wine Industry 2020 Outlook

- The American Wine Consumer

Winery Business Startup Costs

According to Fundera, winery startup costs to consider are as follows:

- Land – likely to cost between $11,000 and $45,000 per acre, cost varies by region.

- Equipment, including refrigeration, cellar equipment, winery buildings, trucks, and receiving equipment

- Vines – around $15,000 to $20,000 per acre in the first three years.

- Fermentation and storage

- Bottling line

- Tasting room

- Staffing

- Marketing

- Business insurance

A small winery may cost approximately $1.5 million in capital investments within the first five years.

Additional winery startup costs information can be found through the following resources:

Winery Business Plans

Winery Business Associations

Trade associations often are excellent sources of information on an industry. Here are some relevant winery industry associations:

- The National Association of American Wineries

- The Wine Institute

- Wine Market Council

- American Wine Society

Winery Business Regulations

The section is intended to provide a general awareness of winery regulations and agencies to consider when starting a winery business. Check with your state and municipality for rules and regulations that may impact the business in your area.

- TTB: Wine Laws, Regulations, and Public Guidance

- Federal Trade Commission: Alcohol Advertising

- FDA: Labeling of distilled spirits, wine, and malt beverages

- Direct Shipping Laws for Wineries

- Control State Directory and Info

Wine and Vineyard Publications

Winery Business Employment Trends

The number and type of employee vary by the nature of the winery:

- As there are many components to the wine production and distribution process, yearly salaries range from Vice Presidents of Sales earning approximately $170,000 to Tasting Room Staff earning approximately $28,000.

- Winery production volume may influence workers’ salaries. A thorough breakdown of the job market in the winery industry can be found in this detailed salary survey from Wine Business Monthly.

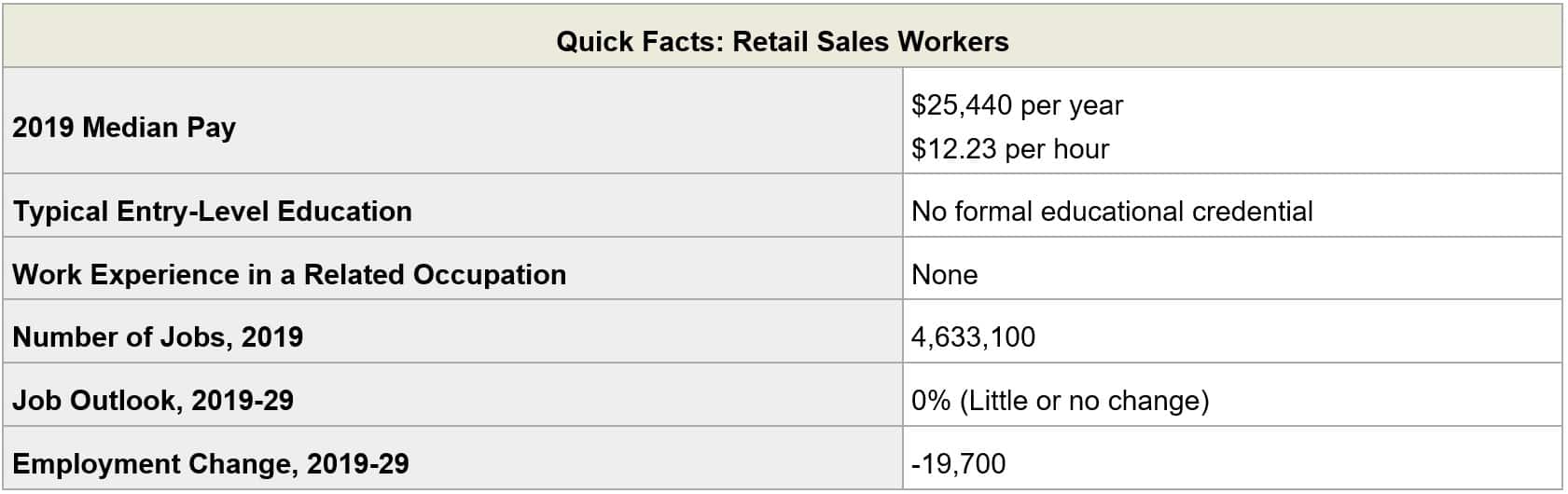

Labor costs are important factors for winery owners. Winery employment encompasses a variety of jobs, the following are insights from the Bureau of Labor Statistics into the most customer-facing employees, retail salespersons. A more specific breakdown of other winery occupations is available from the Bureau of Labor Statistics.

- Work Environment: Most retail sales work is performed in clean, well-lit stores. Retail sales workers spend most of their time interacting with customers, answering questions, and assisting them with purchases. Many sales workers work evenings and weekends, particularly during holidays and other peak sales periods. Because the end-of-year holiday season is often the busiest time for retail stores, many employers limit retail sales workers’ use of vacation time between November and the beginning of January. Some retail salespersons work part time.

- Job Outlook: Employment of retail salespersons is projected to decline 2 percent from 2018 to 2028. Competition from online sales will lead to employment declines in brick-and-mortar retail stores. … Although online sales are expected to continue to increase, brick-and-mortar retail stores are also expected to increase their emphasis on customer service as a way to compete with online sellers. In addition, cost pressure may drive retailers to ask their in-store staff to do more. This means they may want workers who can perform a broad range of job duties that include helping customers find items, operating a cash register, and restocking shelves. Because retail sales workers provide this versatile range of services, they will still be needed in retail stores.”

Additional Small Business Resources

Already in business or thinking about starting your own small business? Check out our various small business resources:

- View more business reports here: Small Business Snapshots

- View small business help topics here: Small Business Information Center

- View industry-specific research here: Market Research Links

- View business plans samples here: Sample Business Plans

Remember, you can also receive free professional business advice and free or low-cost business training from your local Small Business Development Center!

Photo by Maksym Kaharlytskyi on Unsplash