Learn about the Bakery Business and find information on how to open up a Retail Bakery. Don’t forget you can receive free or low-cost training and free professional business advice, from your local Small Business Development Center!

View our related business reports here: Food Industry, Coffee Shop Business, Fast Food Business

Get a free Bakery business plan template on our Business Plans page.

Bakery Business COVID-19 Resources

The global COVID-19 pandemic, shelter-in-place orders and physical distancing measures affected many businesses. Here is a look at the impact to the Retail Bakery Business industry.

At the onset of the pandemic, manufacturing employees contracting coronavirus and mitigation efforts to minimize these caused mass production shutdowns and supply chain disruptions across many industries. The bakery industry, and the food industry as a whole, was not immune to this impact. Though not immune to these challenges, many remained open during this time and over time adapted to the new realities allowing many to thrive. Some bakeries turned to social media to increase marketing efforts, partnered with delivery platforms to minimize in-person business, and shifted to selling groceries or pre-made baking kits. Technology adoption allowed bakeries to remain operational as many turned to the use of touchless payment options. This has been useful to minimize physical contact and meet the challenge of the U.S. coin shortage.

A critical element to bakeries is the workforce, labor shortages is a prominent issue in the industry, causing many bakeries to temporarily or permanently shut down. As the industry enters a “Post-COVID” era, bakeries continue to adapt to overcome the challenges faced. Some bakeries adopted technological innovations to lessen the labor shortage, including conducting virtual interviews to expand talent acquisition.

- SBDCNet COVID-19 Small Business Resources

- ABA – COVID-19: The Baking Industry Responds

- IDDBA – COVID-19 Impact

- FDA – Best Practices for Retail Food Stores During the COVID-19 Pandemic

- CDC – Workplaces and Businesses COVID-19

- Tips for Bakeries in the COVID-19 Environment

Bakery Business Industry Overview & Trends

NAICS Code: 311811, SIC Code: 5461

This Bakery Product Manufacturing industry summary is from First Research which also sells a full version of this report.

- “Companies in this industry make fresh and frozen bread as well as cakes, pies, and Major companies include Dawn Foods, Flowers Foods, Franz Bakery, and McKee Foods (all based in the US), along with Allied Bakeries (UK), ARYZTA (Switzerland), Grupo Bimbo (Mexico), Weston Foods (Canada), and Yamazaki Baking (Japan).

- Because of the perishable nature of bakery products, international trade does not play a major role in the However, disruptions in grain production and trade can have significant effects on global supplies and prices of ingredients. Canada is by far the US’s largest trading partner for both imports and exports of bakery products, followed by Mexico.

- The US bakery products industry includes about 3,000 commercial bakeries with combined annual revenue of about $32 billion, along with about 6,900 retail bakeries with annual revenue of about $4

- Competitive Landscape: Demand is driven by consumer preferences and by the extent to which grocery stores choose to operate their own bakeries rather than buy from commercial bakeries. Profitability for individual companies is determined by efficiency of Large companies have scale advantages in procurement, production, and distribution. Small companies can compete by offering specialty goods or superior local distribution services.”

These Baked Goods market insights are derived from Euromonitor, which also sells a full version of this report.

Stay-at-home orders at the start of the pandemic resulted in renewed interest in home baking during 2020. With recovery efforts under way across the country, more consumers are returning to work, and the home-baking trend is expected to decrease. Baking goods at home requires time, which many people no longer have. This indicates that most consumers are likely to return to purchasing baked goods.

Bakery Business Customer Demographics

Major customer segments for Bakery Cafes are reported by IBISWorld. The full version of the report is available for purchase here.

- IBISWorld estimates 2021 industry revenue to be approximately $11.7 billion, with market segmentation based on purchases of food away from home by household income and identified as a percent of industry revenue.

- Though some households have been impacted by the loss of employment as a result of the COVID-19 recession, the middle-income brackets collectively represent the largest segment at 46.9% of industry revenue.

- With greater disposable income, high income households are more likely to indulge in high-priced baked goods and account for 35.2% of industry revenue.

- The lower income bracket closes out the household segment and represents 8.3% of industry revenue.

- Private and public sector organizations represent 9.6% of the industry revenue.

Customer segments for In-store Bakeries are reported by Mintel. The report is available for purchase.

- Due to the pandemic, 45% of consumers surveyed are eating sweets on a regular basis. Shelter-in-place orders provided exposure to the world of baked goods and baking. As consumers return to the office and lessen at-home baking, opportunities will arise for retail bakeries to tap into this newly engaged audience.

- Consumers under the age of 45 (Millennials), specifically those between the ages of 25-34, increased consumption of baked goods. Options such as healthier ingredients, diet-friendly products (i.e. gluten-free, vegan-friendly, etc.), and unique flavors will attract attention from this group

Find further information on Retail Bakery Business Customers in a variety of web articles:

- Consumers eating more baked goods as a result of pandemic

- Consumers Craving More Baked Goods

- Consumers Want Bakery Goods with Better-For-You Attributes

Retail Bakery Startup Costs

- Bakery Startup Costs from Entrepreneur Magazine: “Total Startup Costs: $10,000 – $50,000”

- Bakery Business Startup Costs from Profitable Venture Magazine: “$50,000 to $150,000”

- Bakery Startup Costs ranges from Best4Businesses: bakery: $62,000-$77,500; online bakery: $26,800-$30,000; and home-based bakery: $15,500-$23,500

- Bakery Startup Costs from Harbortouch: startup cost of approximately $10,000 to $70,000

Retail Bakery Business Plans

- Dessert Bakery Business Plan

- Bakery Business Plan Template

- Bakery Business Plan Sample

- Bakery Business Plan Templates for 2021

- Bakery Business Plan Template [2021 Updated]

- How to Prepare a Business Plan for a Bakery

- All Business Plans from SBDCNet

Bakery Business Associations

Trade associations often are excellent sources of information on an industry. Here are some relevant industry associations:

- Retail Bakers of America

- American Bakers Association

- American Society of Baking

- American Culinary Federation

Bakery-Related Business Regulations

The section is created to provide a general awareness of regulations and agencies to consider when starting a Bakery Business. Check with your state and municipality for rules and regulations that may impact the business in your area. Operations working out of the home would follow state or local regulations for the cottage food industry.

Most federal regulations are for general food safety, labor, and safety standards as dictated by the Food and Drug Administration (FDA), Department of Labor (DOL), the Occupational Safety and Health Administration (OSHA) along with guidance from trade associations.

Regulations, Acts and Laws pertaining to Bakery Businesses:

- FDA – How to Start a Food Business

- FDA – Food Code

- FDA – Food Allergen Labeling and Consumer Protection Act (FALCPA)

- DOL – Wages and the Fair Labor Standards Act

- OSHA – 1910.263 Bakery equipment standards

Additional information on regulatory compliance is available from the American Institute of Baking

Bakery Business Publications

- Baking Business

- Snack Food & Wholesale Bakery

- American Cake Decorating Magazine

- Bakers Journal

- Bake Magazine

- Baking From Scratch

Bakery Employment Trends

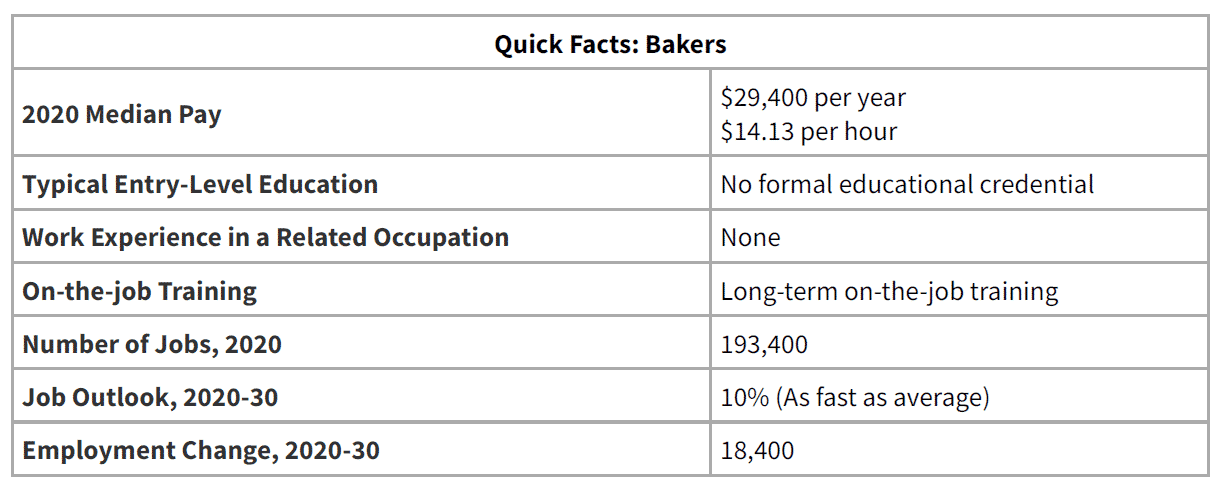

Here is the Bakers labor market summary from the Bureau of Labor Statistics.

- “Pay: The median annual wage for bakers was $29,400 in May 2020. The median wage is the wage at which half the workers in an occupation earned more than that amount and half earned less. The lowest 10 percent earned less than $21,070, and the highest 10 percent earned more than $43,310.”

- “Work Environment: Bakers held about 199,300 jobs in 2019. The work can be stressful because bakers follow time-sensitive baking procedures and often work under strict deadlines. For example, bakers must follow daily production schedules to bake products in sufficient quantities while maintaining consistent quality. In manufacturing facilities, they often work with other production workers, such as helpers and maintenance staff, so that equipment is cleaned and ready. Bakers are exposed to high temperatures when working around hot ovens. They stand for hours at a time while observing the baking process, making the dough, or cleaning the baking equipment.”

- “Job Outlook: Employment of bakers is projected to grow 5 percent from 2019 to 2029, faster than the average for all occupations. About 28,300 openings for bakers are projected each year, on average, over the decade. Many of those openings are expected to result from the need to replace workers who transfer to different occupations or exit the labor force, such as to retire.”

Additional Resources

Already in business or thinking about starting your own small business? Check out our various small business resources:

- View more business reports here: Small Business Snapshots

- View small business help topics here: Small Business Information Center

- View industry-specific research here: Market Research Links

- View business plans samples here: Sample Business Plan

Remember, you can also receive free professional business advice and free or low-cost business training from your local Small Business Development Center!

Photo by Mink Mingle on Unsplash