This COVID-19 small business resource guide is committed to providing the latest information, tools and support available to small businesses impacted by the COVID-19/novel coronavirus outbreak. This page will be updated frequently as new federal, state and private resources to assist small businesses become available. Additionally, you can also receive professional business advice and free or low-cost business training from your local Small Business Development Center!

Updated January 7th, 2022

About COVID-19, also known as the Novel Coronavirus

SARS-CoV-2, or Severe Acute Respiratory Syndrome Coronavirus 2, is the formal designation for the virus that causes COVID-19, or Coronavirus Disease 2019. Comprehensive information regarding the virus, disease and protection measures can be found at the U.S. Center for Disease Control and Prevention and the World Health Organization. With global spread at an alarming rate, the World Health Organization declared this outbreak a pandemic on March 11th, 2020.

According to the CDC, the two variants of concern are Delta, which was the predominant strain in the U.S. in Summer 2021 and Omicron, the most recent to emerge, currently most predominant strain, and seemingly most rapidly spreading throughout the U.S.

COVID-19 Small Business Resources & Assistance

The United States Congress passed the Coronavirus Aid, Relief and Economic Security (CARES) Act and the Families First Coronavirus Response Act in March 2020 to provide federal government support in response to the COVID-19/novel coronavirus outbreak. After the initial funds were exhausted, Congress passed the Paycheck Protection Program & Health Care Enhancement Act in April 2020 to provide an additional $380 billion to resume the Paycheck Protection Program (PPP) and Economic Injury Disaster Loan (EIDL) program.

The U.S. Small Business Administration (SBA) is continuing to lead the rollout of assistance for America’s small businesses. This includes the Paycheck Protection Program (PPP), the Economic Injury Disaster Loans (EIDL), SBA Debt Relief on new and current 7(a) loans, SBA Express Bridge Loans and additional guidance to businesses and employers. Learn more about the SBA COVID-19 relief options here. You can also find COVID-19 Recovery Information in other languages.

Paycheck Protection Program

This program is a loan offering designed to provide a direct incentive for small businesses to retain their workers and cover certain other expenses. Eligible recipients may qualify for a loan up to $10 million. If employee retention criteria is met, SBA will forgive the portion of the loan proceeds that are used to cover the first 24 weeks of payroll, rent, mortgage interest and utilities.

Any small business with less than 500 employees (including sole proprietorships, independent contractors and self-employed persons), private non-profit organizations or 501(c)(19) veterans organizations affected by the outbreak are eligible.

As of May 5, 2021, funding for the Paycheck Protection Program has been exhausted. The SBA will continue funding outstanding approved PPP applications, but new qualifying applications will only be funded through Community Financial Institutions, financial lenders who serve underserved communities.

President Biden announced program changes to make access to PPP loans more equitable under the American Rescue Plan Act. Included in the American Rescue Plan Act is relief for small businesses and hard-hit industries.

The American Rescue Plan Act of 2021, signed into law in March 2021, provides additional relief for the nation’s small businesses and hard-hit industries for programs SBA is currently administering and adds new efforts, including:

- $7.25 billion additional for the Paycheck Protection Program, including eligibility to additional nonprofits and digital news services, ended May 31, 2021

- $16 billion Shuttered Venue Operators Grant (SVOG)program providing funds for live event venues. Additional funds made available allowed businesses to apply for both a PPP loan after Dec. 27, 2020, and the SVOG. As of August 20, 2021, SVOG is no longer accepting new applications.

- $15 billion additional for Targeted Economic Injury Disaster Loan (EIDL) Advance payments, including new $5 billion for supplemental Targeted EIDL Advance payments for those hardest hit. As of January 1, 2022, COVID EDIL is no longer accepting new applications.

- $28.6 billion Restaurant Revitalization Fund for industry-focused grants. The National Restaurant Association published a Policy Brief on the Restaurant Revitalization Fund outlining key elements. Applications are now closed.

Learn more about the SBA Paycheck Protection Program here.

For small businesses who secured the PPP loan, a key benefit was funds designated for specific expenses made the loan forgivable. The SBA opened the PPP Loan Forgiveness portal on August 10, 2021 and revised their Frequently Asked Questions on March 12, 2021. The most recent guidance streamlines the forgiveness process for Paycheck Protection Program loans under $50,000 through the use of form 3508S. Form 3508EZ is available to sole proprietors, independent contractors, self-employed and all other business entities can use form 3508.

Provided below are resources on navigating and understanding the process.

- SBA Paycheck Protection Program Loan Forgiveness Factsheet

- U.S. Chamber Guide to PPP Loan Forgiveness – designed to help borrowers understand the loan forgiveness process to include loan forgiveness amount calculation.

- Paycheck Protection Program resources for CPAs – resources from the American Institute of CPAs

- PPP Loan Forgiveness Application Guidance for the Self-Employed, Freelancers and Contractors – article from Forbes offering guidance to navigate the application process.

Economic Injury Disaster Loans & Loan Advances

The U.S. Small Business Administration announced on March 12, 2020 that they will be processing disaster assistance loans for small businesses negatively impacted by COVID-19/novel coronavirus and the federal, state and local efforts to combat the spread. This assistance program provides targeted, low-interest disaster recovery loans up to $2 million and loan advances up to $10,000 to small businesses. These loans provide working capital to support small businesses that are experiencing temporary loss of revenue as a result of the outbreak. Complete eligibility criteria can be found in the online application. On June 15, 2020, SBA began accepting new Economic Injury Disaster Loan (EIDL) and EIDL Advance applications from qualified small businesses and U.S. agricultural businesses.

The COVID-19 Economic Injury Disaster Loan (COVID EIDL) application is closed as of January 1, 2022, at 12:00 AM ET. SBA is no longer accepting new COVID EIDL loan applications.

Downloadable PDFs offering supporting guidance by the SBA:

- EIDL Sample Application

- COVID-19 EIDL Program (portal walkthrough) step-by-step example of how to apply for SBA’s COVID-19 EIDL program

- COVID-19 EIDL intake application form checklist – supplemental checklist to assist a small business in completing the EIDL Intake Application Form

- FAQ regarding EIDL

- EIDL Program Updates – summary of program policy changes effective September 8, 2021

For additional information, please contact the SBA disaster assistance customer service center. Call 1-800-659-2955 (TTY: 1-800-877-8339) or e-mail disastercustomerservice@sba.gov.

Learn more about SBA Disaster Loan Assistance here.

Debt Relief

SBA offers debt relief to existing SBA loan borrowers whose businesses have been impacted by COVID-19.

This program will provide reprieve to small businesses as they overcome the challenges created by the outbreak.

For new 7(a) loans issued prior to September 27, 2020, the SBA will pay the principal and interest on these loans. For current 7(a) loans, the SBA will pay the principal and interest for a period of six months.

Express Bridge Loans

This program is designed for small businesses who currently have a business relationship with an SBA Express Lender. Loans of up to $25,000 can be secured with a fast turnaround to provide bridge funding to cover immediate expenses while the small business applies for or awaits disbursement of a direct SBA Economic Injury Disaster Loan (see above). Notice: the Express Bridge pilot loan program expired March 13, 2021.

Learn more about SBA Express Bridge Loans here.

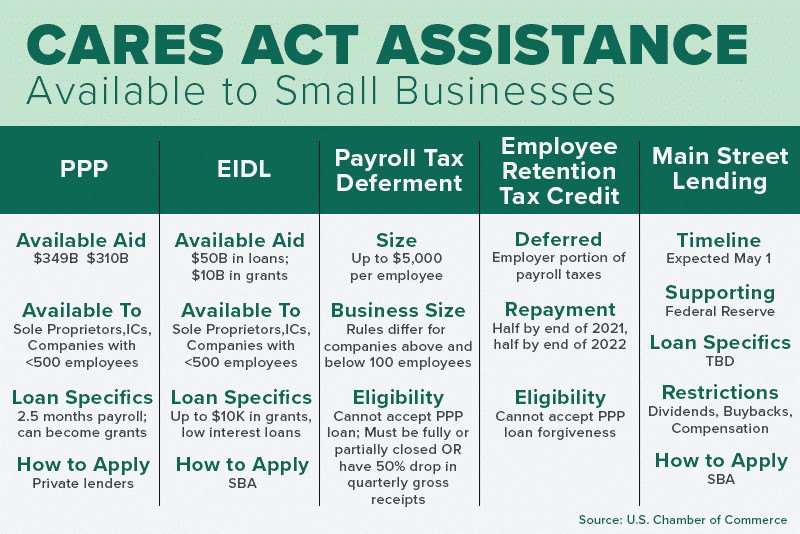

COVID-19 Small Business Financial Aid & Tax Guide

The U.S. Chamber of Commerce, as part of their Save Small Business Initiative, has prepared the following comparison guide to assist small businesses with evaluating their options:

Guidance for Businesses & Employers

The following interim guidance is based on what is currently known about the Coronavirus Disease 2019 (COVID-19). For updates, visit the U.S. Center for Disease Control and Prevention and the World Health Organization.

Interim Guidance for Businesses and Employers to Plan and Respond to Coronavirus Disease 2019 (COVID-19) – guidance that may help prevent workplace exposure in non-healthcare settings. See guidance for Healthcare Professionals here.

Detecting Scams & Fraud

Scammers and other bad actors are actively using these opportunities to defraud individuals and small businesses as well as compromise sensitive information. This includes the fraudulent use of the U.S. Small Business Administration (SBA)’s name and logo in phone calls, emails, text messages and letters. The SBA has provided the following guidance:

- If you are contacted by someone claiming to be from the SBA – suspect fraud.

- Email address from SBA or other legitimate government agencies will always end in .gov.

- There is no cost to apply for a COVID-19 Economic Injury Disaster Loan and SBA will never ask you to provide a credit card.

- Do not release any private information (SSN, DOB, etc.) or banking information in response to an unsolicited caller, letter, email or text.

- An SBA logo in an email or webpage does not guarantee the information is accurate or from the SBA.

- Check for spelling and grammatical errors in an email and be wary of clicking on any links or opening attachments.

- If you are in the process of applying for an SBA loan and receive correspondence asking for PII, ensure that the referenced application number is consistent with your application number.

- For help with Economic Injury Disaster Loans, please contact the SBA disaster assistance customer service center. Call 1-800-659-2955 (TTY: 1-800-877-8339) or send an e-mail to disastercustomerservice@sba.gov.

- For inquiries regarding SBA support for small businesses, send an email to answerdesk@sba,gov.

Be vigilant and trust your instincts. If something seems too good to be true, then it likely is.

Other Federal COVID-19 Small Business Resources

Main Street Lending Program – The Federal Reserve established the Main Street Lending Program to support lending to small and medium-sized businesses. The program ended on January 8, 2021.

U.S. Department of Labor Coronavirus Resources covering issues such as workplace safety; wage, hours, and leave; unemployment insurance flexibilities; and injured federal workers.

Occupational Safety and Health Administration Guidance on Preparing Workplaces for COVID-19.

Centers for Disease Control Coronavirus Resources for Businesses and Employers, community resources , and business reopening guidance

FEMA Coronavirus best practices, fact sheets, and other community resources

FEMA Toolkit for Businesses Resuming Operations – provides content to conduct a workshop for resuming operations.

State COVID-19 Small Business Resources

While their are numerous federal resources and assistance programs underway, many states and municipalities have established resources and financial assistance programs for their local small businesses. The following are specific state COVID-19 small business resources. If you are aware of other resources in your state we should include, please Contact Us.

Alabama

Alabama SBDC – COVID-19 Resources

Coronavirus (COVID-19) Updates – Alabama Department of Revenue

Business Resources for Coronavirus Response – Chamber of Commerce Association of Alabama

COVID-19 Resources for Small Business – Atlas Alabama

Made in Alabama: Information and Resources for Businesses – Alabama Department Of Commerce

Alaska

Business Resources for Coronavirus – Alaska Chamber

Arizona

Arizona SBDC – COVID-19 Resource Guide

Resources and Information for Arizona Small Businesses Affected by COVID-19

COVID-19 Resources: What you need to know – Arizona Small Business Association

Arizona COVID-19 Business Resources – Arizona Commerce Authority

Covid-19 Recursos Empresariales de Arizona – Arizona Commerce Authority (Spanish version)

Coronavirus Information Center – Chamber Business News, a project of the Arizona Chamber Foundation

Arkansas

Arkansas SBTDC – COVID-19 Resources

COVID-19 Resources for Businesses and Employers – Arkansas Economic Development Commission

COVID-19, Coronavirus & Arkansas – Arkansas State Chamber of Commerce

California

California SBDC – COVID-19 Resources

Coronavirus 2019 (COVID-19) Resources – California Office of Business and Economic Development

Disaster Relief Loan Guarantees – Small Business Finance Center (SBFC) – California Infrastructure & Economic Development Bank

Economic Development Resources for COVID-19 – California Association for Local Economic Development

Coronavirus (COVID-19) Business Resources – CalChamber

Stabilization, Opportunity, and Resilience (SOAR) Loan Program – Superior California Economic Development (SCED) providing short-term working capital loans from $5,000 to $20,000

Colorado

Colorado SBDC – COVID-19 Small Business Response Resources

Coronavirus Disease 2019 (COVID-19) in Colorado – state and national resources from the Colorado Department of Public Health & Environment and State Emergency Operations Center

Colorado Chamber of Commerce – COVID-19 Updates and Resources

COVID-19 News, Data & Resources – Economic Development Council of Colorado

Connecticut

Connecticut SBDC – COVID19 Recovery Resources

CT Business Assistance for Reopening – State of Connecticut

Coronavirus Business Recovery Resources – Connecticut Department of Economic and Community Development

Delaware

Delaware SBDC – COVID-19 Resources

COVID-19 Information for Delaware Small Businesses – Delaware Division of Small Business

Delaware Small Business Relief Grants – Delaware Division of Small Business is committing $100 million to assist Delaware businesses and nonprofits affected by the COVID-19 crisis. Eligible businesses may receive up to $100,000 to cover COVID-19-related expenses.

Delaware Chamber of Commerce – Coronavirus Resources for Businesses

Florida

Florida SBDC – COVID-19 Resources

COVID-19 Business Resources & Economic Relief – Florida Chamber of Commerce

COVID-19 Resources for Florida Businesses – Enterprise Florida

COVID-19 Resource Hub – Florida Economic Development Council

Georgia

Georgia SBDC – Response and Recovery

Georgia Department of Economic Development: COVID-19 Updates and Information

COVID-19 Relief Resources – Georgia Minority Supplier Development Council

Hawaii

One808 COVID-19 Resource Center

Dept. of Economic Development: COVID-19 Hawaii Business Resource Page

Resources for Hawai’i Small Businesses During the Coronavirus Pandemic

Idaho

Idaho Department of Commerce COVID-19 Information

COVID-19 Resources – Idaho Economic Development Association

Illinois

Restore Illinois Phase 5 Reopening Guidelines – Illinois Department of Commerce & Economic Opportunity

COVID-19 Emergency Small Business Assistance Initiatives

Small Business COVID-19 Relief Program – Invest in Illinois

COVID-19 Resources – Illinois Economic Development Association

Indiana

Indiana SBDC – COVID-19 Small Business Resources

Indiana COVID-19 Business Resource Center

Information and Resources for Small Businesses – Indiana Chamber of Commerce

COVID-19 Resources – Indiana Economic Development Association

Iowa

Iowa SBDC – COVID-19 Resources

Guidance for Iowa Businesses During COVID-19 – Iowa Source Link

Kansas

Kansas SBDC – COVID-19 Small Business Resources

Kansas Department of Commerce COVID-19 Response

Kansas Chamber of Commerce Resources for Businesses

Coronavirus (COVID-19) Business Resources & Updates

Coronavirus Resources – Kansas Economic Development Corp

Kentucky

Kentucky SBDC – COVID-19 Resources

COVID-19 Resources & Actions – Kentucky Economic Development Association

Louisiana

Louisiana SBDC – COVID-19 Resources

Louisiana Economic Development (LED) Resources for Impacted Businesses

Maine

Maine SBDC – COVID-19 Resources

Taking Care of Business during COVID-19 Crisis – Maine State Chamber of Commerce

Maine Resource Compass – Grants and loan programs for entrepreneurs and small businesses

Maryland

Maryland SBDC – COVID-19 Assistance

Massachusetts

Massachusetts SBDC – COVID-19 Resources

Assisting Small Businesses Recovering from the COVID-19 Crisis

MassEcon COVID-19 Resource Center

COVID-19 Resources for Massachusetts Small Businesses

Michigan

Michigan SBDC – Resources to guide your business through COVID-19

Resources for Michigan Businesses during COVID-19 – Michigan Economic Development Corporation

Minnesota

Minnesota South Central Regional Center SBDC – COVID-19 Guidance for Small Business

COVID-19 Information & Resources – resources for small businesses

COVID-19 Business Toolkit – Minnesota Chamber of Commerce

Mississippi

Mississippi SBDC – COVID-19 Resources

Mississippi Emergency Management Agency COVID-19 Resources – state of emergency declaration, testing sites, and closures

Coronavirus Resources for Employers – Mississippi Economic Development Council

Missouri

Missouri SBDC – COVID-19 Resources

Small Business Disaster Loan Program – Missouri Department of Economic Development

MO COVID-19 Business Resources – Missouri Dept. Health Services

Coronavirus (COVID-19) Business Resources & Updates – MoSourceLinkk

Montana

Montana Department of Commerce – Business Recovery Assistance

Montana COVID-19 Community Resources

COVID-19 Resources for Montana Employers – Montana Dept. Of Labor

COVID-19 Resources for Businesses – Montana Chamber of Commerce

Nebraska

Nebraska SBDC – Business Resiliency Resources

Nebraska COVID-19 Community Resources

Department of Economic Development COVID-19 Information

Nevada

Nevada SBDC – COVID-19 Resources

Nevada Business and Industry Compliance – Nevada Department of Health and Human Services

New Hampshire

New Hampshire SBDC – COVID-19 Resources

COVID-19 NH Business Resources

New Jersey

New Jersey SBDC – COVID-19 Resources

COVID-19/Novel Coronavirus Information for New Jersey Businesses

New Jersey Business & Industry Association Coronavirus Resource & Recovery – Select Grants & Loans and other related resources from navigation menu

New Mexico

New Mexico SBDC – COVID-19 Resources

New Mexico Small Business Investment Corp. – funding added to support small businesses impacted by COVID-19

New Mexico Economic Development Department – COVID-19 Business and Economic Recovery Resources

Information for Workers & Businesses Affected by COVID-19

Finance New Mexico Grant & Loan Resources for Businesses

New York

New York SBDC – COVID-19 Resources

COVID-19 Assistance & Guidance for Businesses

Economic Recovery and COVID-19 Loans for Small Businesses – NY Empire State Development

COVID-19 Updates and Resources – New York State Economic Development Council

New York Forward Loan Fund – An economic recovery loan program aimed at supporting New York businesses, nonprofits, and small landlords in re-opening after the COVID-19 crisis

North Carolina

North Carolina SBTDC – Navigating Your Business through COVID-19

COVID-19 Resources for Businesses and Employers – North Carolina DHHS

Resources for N.C. Businesses COVID-19 – North Carolina Dept of Commerce

North Dakota

North Dakota SBDC – Business Continuity

COVID-19 Business and Employer Resources – North Dakota State Government

COVID-19 Resources – Economic Development Association of North Dakota

Ohio

Ohio SBDC – COVID-19 Recovery Resource Center

Ohio Chamber of Commerce – COVID-19 Business Resources

Ohio Women’s Small Business Accelerator – COVID-19 Resources

Businesses/Employers – COVID-19 Checklist

Oklahoma

Tulsa Regional Chamber – COVID-19 Resources

COVID-19 Resources – Oklahoma Department of Commerce

Oklahoma Economic Development Authority COVID-19 Resources

Oregon

Oregon SBDC – COVID-19 Business Resources

COVID-19 Response and Resources – Business Oregon

Assisting Businesses with Coronavirus Impact – Oregon Economic Development Association

Pennsylvania

Pennsylvania SBDC – Disruption Recovery

Bucknell SBDC Covid-19 Small Business Resources – list of COVID-19 resources including reopening assistance, guide to accessing PPE supplies, and financial help to assist Pennsylvania small businesses

Responding to COVID-19 – for businesses

Business Resources for Coronavirus – Pennsylvania Chamber of Business and Industry

COVID-19 Resources for Businesses – Pennsylvania Department of Economic Development

Rhode Island

Rhode Island SBDC – COVID-19 Resources and Information

COVID-19 Resources – Rhode Island Commerce Corporation

South Carolina

South Carolina SBDC – COVID-19 Resources

Dept. of Health and Environmental Control: Businesses & Employers (COVID-19)

South Carolina Department of Commerce COVID-19 Resources

Coronavirus (COVID-19) Resources – South Carolina Association for Community Economic Development

South Dakota

COVID-19 Resources – South Dakota Governor’s Office of Economic Development

Tennessee

Tennessee SBDC – COVID-19 Resources

COVID-19 Small Business Resources

COVID-19 Economic Recovery – Tennessee Chamber of Commerce

Texas

Texas Gulf Coast SBDC – COVID-19 Resources

South-West Texas Border SBDC – COVID Business Recovery Accelerator

Northwest Texas SBDC – COVID-19 Resources

COVID-19 Business Resources – Texas Economic Development

COVID-19 Resources for Employers – Texas Workforce Commission

COVID-19 Resources, Updates & Links – Texas Economic Development Council

TSBEMS Small Business Grant – Texas Small Business Emergency Micro-Grant Source

Utah

Utah SBDC – COVID-19 Resources & Information

Coronavirus Resources for Businesses

Coronavirus Updates – Utah Governor’s Office of Economic Development

Vermont

Vermont SBDC – COVID-19 Resources

COVID-19 Recovery Resource Center – Vermont Agency of Commerce and Community Development

Virginia

Virginia SBDC – COVID Business Recovery Center

COVID-19 Resources – Virginia Economic Developers Association

Washington

Washington SBDC – COVID-19 Resources

Washington State Coronavirus Response (COVID-19)

COVID-19 Resource Directory – Washington Economic Development Association

Washington State Small Business Guidance: COVID-19 Business Resources – Listing of state and local resources, including funding opportunities.

Washington, DC

Recovery Resources for Businesses

COVID-19: Business Guidance & Resources – Washington DC Economic Development Partnership

West Virginia

West Virginia SBDC – COVID-19 Resources

Coronavirus Disease (COVID-19) – information from the Department of Health and Human Resources

COVID-19 Business Relief Resources – West Virginia Development Council

Wisconsin

Wisconsin SBDC – COVID-19 Resources

COVID-19 Business Resources – Wisconsin Economic Development Corporation

Wyoming

Wyoming SBDC – COVID-19 Resources

COVID-19 Response Tips for Small Businesses – The Wyoming Business Council creates business relief grant programs to distribute $325 million of federal Coronavirus aid to Wyoming’s small business owners who have experienced hardship related to the Coronavirus pandemic.

Private Sector Resources for Small Businesses

While federal, state, local governments are providing financial assistance to small businesses, so too has the private sector stepped up to support entrepreneurs. The following are select resources from private sector.

Comprehensive Guides

Find Funding Assistance & Relief by State – small businesses funding by states (federal and private)

Funds for Coronavirus Relief Provided By Candid – a compiled list of funds specifically established for businesses affected by the coronavirus pandemic

US Chamber of Commerce: A State-by-State Guide to Coronavirus Financial Assistance – state and regional financial assistance opportunities for small businesses

The Big List of COVID-19 Financial Assistance Programs for Small Businesses by State – a comprehensive guide of financial assistance programs for small businesses hurt by the outbreak of COVID-19 by state and county

Resources for Women-Owned Businesses – funding resources for women owned businesses

Small Business Assistance

Small Unites – Capital One Business, GoFundMe, HundredX, the National Urban League and Ogilvy partnered in creating Small Unites, a platform where individuals and businesses can utilize a $50 million collective investment of time, resources and donations.

Wefunder helping small businesses – Wefunder has funded ~$130M in hundreds of small businesses from over 400,000 investors.

Zapier helps most impacted small business customers – committing $1 million to help our most impacted small business customers

GoFundme Small Business Relief Fund – helping small businesses to collect money for funding

Mailchimp Relief Fund – giving $10 million in Mailchimp service to our small business customers who have been impacted by the COVID-19 crisis.

Kabbage Helping Small Businesses – launched an online hub to boost sales by including through a system where businesses can sell gift cards to consumers for use at a later date.

AT&T COVID-19 response – business continuity solutions and offers

LinkedIn offering free courses for working remotely –free learning path with online courses.

Cisco WebEx COVID-19 – committing $225 million in cash, in-kind, and planned-giving to support both the global and local response to COVID-19.

Zoom Support during the COVID-19 pandemic – articles and video tutorials on effectively using Zoom to navigate the coronavirus pandemic. Offering free for personal meetings for small businesses.

Bauer Internet Free Video Conferencing – Bauer Internet is offering free video conferencing to businesses and schools.

Verizon COVID-19 Resources – tools and resources for businesses affected by COVID-19

Competitive Grants

Visa Foundation Grants – committing $210 Million to Support Small and Micro Businesses and Immediate COVID-19 Emergency Relief

Hello Alice Small Business Grants – offering up to $10,000 emergency grants, being distributed to small business owners impacted by this pandemic.

Women-Owned and Minority-Owned Business Resources

COVID-19 Relief on IFundWomen – Women entrepreneurs may benefit from grants and other relief funding from I Fund Women.

NALCAB Mobilizes $6 Million in Emergency Funding – National Association for Latino Community Asset Builders is partnering with various organizations to provide $6 million in emergency funding for small businesses and nonprofit organizations that have been impacted by the COVID-19 crisis.

Wells Fargo Open for Business Fund – Aimed at supporting Black and African-American-owned small businesses, Wells Fargo is donating approximately $400 million in processing fees to help small businesses impacted by COVID-19.

Caress IFundWomenofColor COVID-19 Grant – Caress has committed $1 million to supporting women of color small businesses owners who have been directly impacted by COVID-19 in collaboration with IFundWomen of Color funding platform.

Additional Resources

Already in business or thinking about starting your own small business? Check out our various small business resources:

- View small business help topics here: Small Business Information Center

- View business reports here: Small Business Snapshots

- View industry-specific research here: Market Research Links

Remember, you can also receive free professional business advice and free or low-cost business training from your local Small Business Development Center!

If you have a small business resource you think should be included here, please Contact Us.

Photo by Fusion Medical Animation on Unsplash