Learn about the Pet Supply Store industry and find information on how to start a pet supply business. Don’t forget you can receive free or low-cost training and free professional business advice, from your local Small Business Development Center!

View our related business reports here: Pet Care Services Business

Get a free Pet Supply Business plan template on our Business Plans page.

Pet Supply Store Business COVID-19 Resources

The global COVID-19 pandemic, shelter-in-place orders and physical distancing measures have affected many businesses. Here is a look at the impact to the Pet Supplies industry.

Pet stores are expected to have an increase in sales as pet owners are stocking up on pet products. Additionally, many people began fostering and adopting animals during stay at home orders. According to Retail Dive, Petco and PetSmart had a foot traffic increase of 8% and 6% in mid-March 2020. However, many people are shifting their buying habits online and limiting non-essential trips to public spaces. Here are additional COVID-19 business resources specific to this industry:

- SBDCNet COVID-19 Small Business Resources

- CDC COVID-19 Recommendations for Pet Stores

- Pet Food Institute Resources and Information Regarding COVID-19

- American Pet Products Association COVID-19 Resources

- COVID-19 Resources for Retailers

Pet Retail Industry Overview & Trends

NAICS Code: 453910, SIC Code: 5999

Pet Supply Stores are a significant part of the pet industry with a large impact on the US economy. In 2019, pet owners spent $95.7 billion on their pets according to the American Pets Product Association. Pet Food & Treats accounted for $36.9 billion of the industry’s 2019 revenue. Total industry expenditures are expected to increase to $99.0 billion in 2020.

This Pet and Pet Supplies store industry summary is from First Research which also sells a full version of this report.

- “Companies in this industry operate physical retail establishments that sell pets, pet foods, and pet supplies. Major companies include PetSmart, PETCO Animal Supplies Stores, and Petland (all based in the US), along with Global Pet Foods and Pet Valu (Canada), and Pets at Home (UK). The global pet and pet supply store market is concentrated in the Americas, Europe, and the Asia/Pacific region; pets are less common in South Asia, Africa, and the Middle East. Major pet populations exist in Brazil, China, Russia, France, and Japan. However, the largest pet market by a wide margin is the US.

- The US pet and pet supply store industry includes about 9,750 establishments (single-location companies and units of multi-location companies) with combined annual revenue of about $17.2 billion.

- Competitive Landscape: Pet ownership drives demand, and spending generally resists economic cycles. Profitability for individual companies depends on the ability to generate store traffic and effective merchandising. Large companies offer low prices and wide selections of both products and services. Small companies compete effectively by serving a local market, selling unique products, offering specialized services, or providing pet expertise. The US industry is concentrated: the four largest companies account for more than two-thirds of revenue. Competitors include grocery stores, warehouse clubs, mass merchandisers, internet retailers, and some veterinary clinics.”

These Pet Products business market insights are derived from Euromonitor which sells a full version of their report.

- Humanization trend offers opportunities for pet supplies: Americans are increasingly willing to spend more on their companion animals and treat their pets as family members. Pet owners are providing comfort and style for their pets by purchasing pet beds, sofas and other furniture.

- Pet Health: Pet owners are more interested than ever in dietary supplements for their pets to keep their pets healthy. CBD is one of the largest products in this segment. More discerning and informed pet owners are also paying attention to ingredients in products and as well as manufacturing location.

- Increase E-commerce Pet Products Sales: Large companies such as Amazon and Chewy are becoming bigger players in the pet supply industry. People interested in saving time and effort have begun buying pet products online. Internet sales of pet products will likely continue to grow in line with other online sales.

- Basic Pet Supplies: Interestingly, for basic pet supplies such as dog leashes, people tend to look for the best value rather than the most features/highest quality. Consumers prefer to be more discerning on products that directly impact their pets’ health. However, they are willing to save a few dollars on basic products such as leashes, toys, and cat litter. Larger operators may capitalize on this by bringing in their own private label brands to fill this niche.

The AVMA provides a table with data on relevant pet statistics here along with formulas for estimating the number of pets in a community using the human population of the area and the estimated rate of pet ownership.

Pet Supply Store Customer Demographics

IBISWorld reports on the major market segments for Pet Stores in the US. The full version of the report is available for purchase here.

- IBISWorld estimates 2020 industry revenue to be approximately $20.8 billion, with market segmentation determined by consumer age groups.

- Consumers under the age of 25 comprise only 7.3% of industry revenue but they have an extremely large influence on the pet industry, well above their spending power. Although they are not spending large amounts of money, they are very influential on their parent’s spending decisions on family pets. However, demand from this segment is stagnant as their interests continue to shift towards technology and electronics.

- Consumers between the ages of 25 and 44 are 33.1% of industry revenue. Young families are often interested in pets to raise alongside their children for companionship and to teach their children responsibility and as such, have a high pet ownership rate. Demand from this segment is growing.

- People in the age range of 45 to 64 are the largest market segment at 43.5%. With steady income and high pet ownership, this group consistently spends on pet products. As their children become adults and move out, many people in this age range begin spending more on pets as companions.

- Peoples 65 and older are 16.1% of industry revenue. With their children grown, many people in this age group adopt pets for companionship and spend high amounts for their care and comfort.

Find further information on pet supplies customers in a variety of topical and trade publications, including:

- Pet Supplies Demographics

- 2018 Pet Supplies Spending

- Pet Food Trends at Global Expo 2020

- 2019-2020 APPA Pet Owners Survey (available for purchase)

Pet Supply Store Business Startup Costs

According to an analysis done by Chron, the cost for pet supply stores varies greatly depending on the structure of the business. If opening a franchise, consult your franchise paperwork for their specific cost to open. Here is a summary of total startup costs from Chron:

- “Essentially, the four types of pet stores to consider are franchises, independently owned, retail and online…

- Product resellers usually need $15,000 to $30,000 to get started, although home-based sellers can get away with much less.

- Pet product manufacturers may need as little as $30,000 or as much as $500,000 to get started.”

Entrepreneur Magazine estimates that starting your own Pet Toys and Accessories business can cost anywhere from $2,000 to $10,000. Find more pet supply business startup costs information through the following resources:

- Requirements Before Opening a Pet Store

- How to Start a Pet Supply Business

- How Much Does it Cost to Open a Pet Store?

- Retail Store Startup Costs

- How Much Does It Cost to Start a Retail Business?

Pet Supply Store Business Plans

- Pet Food Shop Business Plan Template

- How to Write a Business Plan for a Pet Business

- Pet Supplies Business Plan

Pet Supply Store Business Associations

Trade associations often are excellent sources of information on an industry. Here are some relevant pet supply store industry associations:

- Pet Food Institute

- American Pet Products Association

- World Pet Association

- American Veterinary Medical Association

- American Humane

- National Retail Federation

Pet Supply Store Business Regulations

The section provides a general awareness of pet supply store regulations and agencies to consider when starting a Pet Supply Business. Check with your state and municipality for rules and regulations that may impact the business in your area.

Brick and mortar pet supply stores must meet standard local occupancy, safety, and accessibility standards like other retail stores. However, if your pet supply store sells live animals, additional animal welfare regulations may apply.

- USDA Retail Pet Store Regulation (PDF)

- USDA Animal Welfare Act

- Pet Store Laws by State – Humane Society (PDF)

- Business Licensing Requirements by State

Pet and Retail Business Publications

- Pet Age

- The Bark

- Pet Product News

- Pets+ Magazine

- Retail Dive

- Pet Food Industry

- Pet Business

- Independent Retailer

Pet Supply Store Business Employment Trends

The US Census Bureau reports on the size of pet store industry and number of employees (NAICS 453910)

- Approximately 10,109 establishments in the US

- 119,535 total employees across the nation

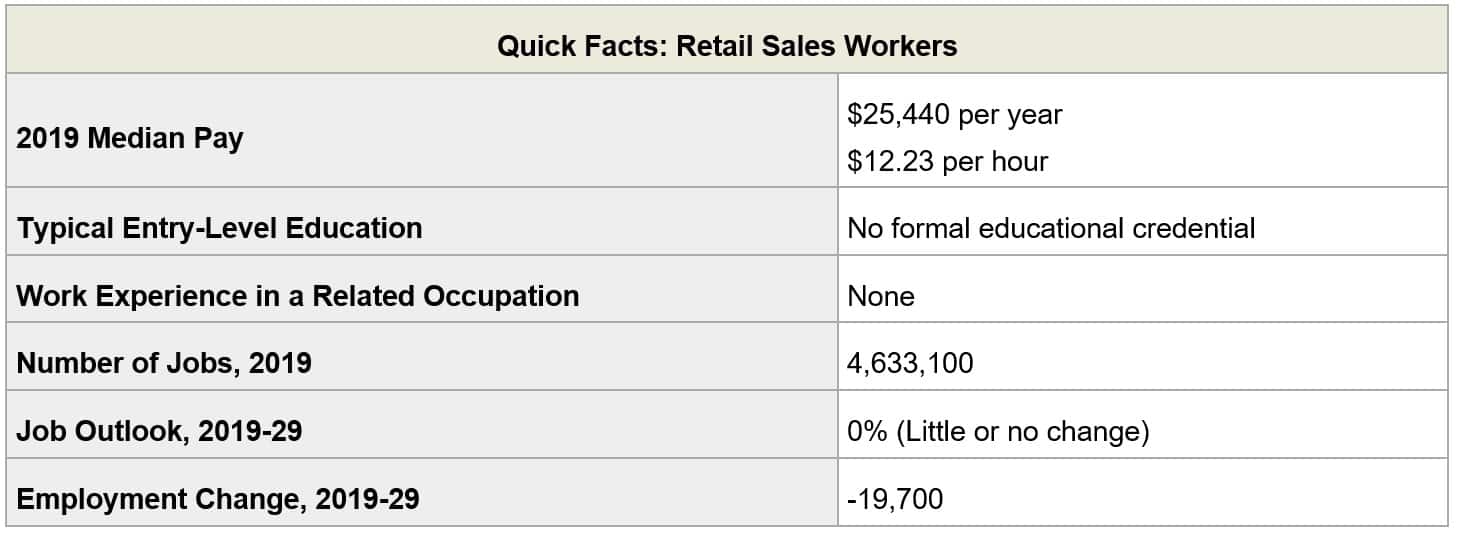

Labor costs are important factors for pet supply stores, as many of their employees are Retail Sales Workers. Here is the data from the Bureau of Labor Statistics.

- “Pay: The median hourly wage for retail salespersons was $12.14 in May 2019. The lowest 10 percent earned less than $9.09, and the highest 10 percent earned more than $20.57.”

- “Work Environment: Parts salespersons held about 261,700 jobs in 2019… Retail salespersons held about 4.4 million jobs in 2019… Most retail sales work is performed in clean, well-lit stores. Retail sales workers spend most of their time interacting with customers, answering questions, and assisting them with purchases. Workers often stand for long periods and may need permission from a supervisor to leave the sales floor.”

- “Job Outlook: Overall employment of retail sales workers is projected to show little or no change from 2019 to 2029. Competition from online sales will lead to employment declines in brick-and-mortar retail stores. The increase in online sales is expected to continue over the next decade, limiting growth in the number of physical retail stores and reducing demand for retail sales workers. Online sales also are projected to affect specific segments of the retail industry to varying extents… Although online sales are expected to continue to increase, brick-and-mortar retail stores are also expected to increase their emphasis on customer service as a way to compete with online sellers. In addition, cost pressure may drive retailers to ask their in-store staff to do more.”

Additional Resources

Already in business or thinking about starting your own small business? Check out our various small business resources:

- View more business reports here: Small Business Snapshots

- View small business help topics here: Small Business Information Center

- View industry-specific research here: Market Research Links

- View business plans samples here: Sample Business Plans

Remember, you can also receive free professional business advice and free or low-cost business training from your local Small Business Development Center!

Photo by Kim Davies on Unsplash