Learn about the Beauty Salon, Hair Salon, Nail Salon and hair care services industries and find information on how to start a Beauty Salon business. Don’t forget you can receive free or low-cost training and free professional business advice from your local Small Business Development Center!

Get a free Beauty Salon, Hair Salon, Nail Salon business plans template on our Business Plans page.

Beauty Salon Business Forecast

The Beauty Salon industry has seen a steady recovery in revenue since the pandemic as consumer discretionary spending began to increase. The Budget and Economic Outlook report by the Congressional Budget Office projects that labor income will increase from 55.9% by the end of 2023 to 57.0% by the end of 2027. Demand for personal care services parallels the current economic outlooks since growth will increase consumers’ discretionary spending. Similar to other service-orientated businesses, beauty salon’s overall performance experienced a massive plummet in revenue during the pandemic due to the high risk of close contact. In 2024 and beyond, as consumer spending increases, the industry losses post-pandemic will begin to level. As trends and the introduction of new salon services emerge, personal care services will experience a boost in revenue.

The generation’s interest in personal care services has led to the prioritization of sustainability and transparency from brands and service providers. A McKinsey & Company report points to the younger generations leading the call for the beauty industry to create products and services that correlate with their definition of self-care. According to a LendingTree survey, Millennials spend an average of $2,670 on personal care products and services, while Generation Z spend an average of $2,048. As their purchasing power grows, beauty salons are honing in on younger generations as their prime consumer segment and curating marketing strategies with them in mind. Personal care services will also need to highlight the value of their offerings since the emergence of “DIY” culture, ushered in by the state-mandated closing of salons during the pandemic. This trend continued after due to the inflationary pressures. To help counteract this new development, salons may seek to utilize influencers or key opinion leaders that will grasp generation interest and lead to an increase in bookings.

In addition to salons focusing on generations, gender will also prove to be a segment worthy of attention. According to a Boulevard study, some key findings included 68% of male clientele visiting the salon more frequently and 67% booking numerous services in one salon visit. Beauty Salons are pivoting to explore this new market and expand its offerings keeping all genders in mind.

- SBDCNet Small Business Pandemic Resources

- PBA: COVID-19 Resources

- COVID-19 Updates for Skin Care

- AACS: Guide to Reopening Salons

- How Hair Salons Will be Transformed by the COVID-19 Pandemic

Beauty Salon Industry Overview & Trends

NAICS Code: 812112; SIC Code: 7231

Beauty Salons are a valued segment of the U.S. personal care services industry with exceptional resilience through economic stressors.

This hair care services industry summary is from First Research which also sells a full version of this report.

- “Companies in this industry operate hair salons and barber shops. Major companies include Regis Salons and Sport Clips (both based in the US), as well as Klier (Germany) and Stefan Hair Fashions (Australia).

- Key sources of growth for the global hair care industry include expanding middle classes in developing nations. Shifting cultural norms also drive demand.

- The US hair care services industry includes about 84,000 establishments (almost 80,000 beauty salons; over 5,000 barber shops) with combined annual revenue of about $25 billion.

- Competitive Landscape: Demand is driven by demographics, population growth, and personal income. The profitability of individual companies depends on effective marketing and maintaining repeat business. Large companies enjoy economies of scale in purchasing and marketing. Small companies can compete successfully by offering superior service or securing favorable locations. The barber shop segment of the industry is fragmented: the 50 largest operators generate less than 30% of US industry revenue; while the beauty salon segment is highly fragmented: the 50 largest beauty salon operators generate about 15% of revenue.

- Products, Operations & Technology: Major sources of revenue are haircutting, hair coloring, nail care, skin care, and merchandise sales. Haircut and styling services account for more than 40%, hair coloring and tinting for nearly 25%, and skin care services for about 5%.”

These hair care business market insights are derived from Euromonitor which sells a full version of their report.

- In 2022 the introduction of new aesthetics brought to light by social media led to purchases of styling products for a minimal clean look. With the ongoing topic of self-care and the introduction of these new fads, consumers are more interested in exploring individuality to break the beauty mold. The purchase of styling agents will experience a decline as consumers seek to express themselves through hairstyles.

- Now that salons are reopening, brands are exploring new ways to display the use of their products with virtual salon experiences. The introduction of new technology will give salons the opportunity to present themselves as a learning environment for clients to understand their hair and provide a sense of comfort in trying new styles.

- Consumers are growing more concerned with the impact of personal care product production on the environment. US consumers are seeking sustainable hair care products, with naturally sourced ingredients. Brands and salons are keeping track of consumers’ demands and seeking ways to implement them in their offerings.

Beauty Salon Technology

Technology plays an important role in the beauty salon industry. Here is information on new technology additions to the salon industry:

- 7 Tech Tools to Transform Your Salon – List of technology transforming the industry.

- How Salons Are Using the Latest Technology to Stay a Cut Above – List of new technology salons are using, and way to implement them.

- Navigating the Future: 5 Salon Trends to Watch in 2024 – Trends and the utilization of AI

- The Digital Transformation of Beauty and Wellness Services – Report on the digital shift in the beauty industry.

- Natural-hair care is getting a boost from AI as Black-owned beauty-tech companies harness personalized data to better serve customers – How salons are using AI for hair care

- VIVA Technology 2023 – List of new technologies and how brands are utilizing them.

For additional information on technology, visit our AI for Small Business Guide.

Hair Salon & Nail Salon Customer Demographics

Major customer segments for hair and nail salons are reported by IBISWorld, which offers full versions of the reports for purchase here.

- The nail and hair salon markets are segmented by age.

- Consumers aged 55 and older frequent salons more for hair care services. Because of their limited mobility, they spend more on hair care services for convenience making up 31.7% of the market share.

- Middle-aged consumers between the ages 45 and 54 make up 20.7% of the market share and have more discretionary income to spend on salon services. They typically seek out hair coloring services.

- The market is benefiting from consumers aged 35 to 44, as they have a higher disposable income giving them the opportunity to spend more during salon visits and book multiple services. These consumers make up 19.5% of the market.

- Younger consumers aged 24 and younger make up 10.7% of the market share and are less likely to spend on high-priced hair and nail services since their disposable income is relatively low.

Additional information on hair and nail salons can be founds on variety of trade association and publication, including:

- Beauty industry statistics for 2023 – Style Seat

- New trends in consumer preferences – Salon Today

- US Consumers keep spending despite high prices and their own gloomy outlook. Can it last? – Impacts of inflation on consumer purchasing behaviors

- Consumers spending on beauty – Beauty Insider

Beauty Salon Business Startup Costs

According to research conducted by Sage.com, Beauty Salon startup costs are as follow:

- “Physical location – If you plan on purchasing a space expect to set aside $40,000 to $250,000 to purchase an existing salon (dependent on location, size, and condition of the property and equipment). Bump that up to $100,000 to $500,000 on average to build a salon from the ground up.

- Salon equipment – equipment costs will vary depending on type of salon. A full hair salon expense list is estimated to total about $27,000. For any type of salon, you’ll need styling stations with chairs, which can range from $200 to upwards of $1,000.

- Initial supplies – Costs will vary by brand but make sure you consider sanitizers, perm rods, hair capes, towels, shampoos, conditioners, specialty polishes and the like. Supplies add up quickly—stocking everything you need can cost up to $20,000 to start.”

Additional beauty salon startup cost information can be found at:

- Cost to become a Hairstylist from Entrepreneur Magazine:

-

- “Startup Costs: Under $2,000

Home Based: Can be operated from home.

Part Time: Can be operated part-time.

Franchises Available? No.”

- “Startup Costs: Under $2,000

- Costs to open a nail salon from Entrepreneur Magazine:

- “Startup Costs: $2,000 – $10,000

Home Based: Can be operated from home.

Part Time: Can be operated part-time.

Franchises Available? No.”

- “Startup Costs: $2,000 – $10,000

- Cost to consider from Cardconnect

- Listing of resources and equipment.

Beauty Salon Business Plans

The following are sample Beauty Salon Business Plans for reference. For Additional business plan samples, visit our Business Plans Guide.

- Hair And Beauty Salon Business Plan – Bplans

- Hair and Nail Salon Business Plan – The Finance Resource

- Beauty Salon Business Plan – Profitable Venture

- Nail Salon Business Plan – Profitable Venture

Beauty Salon Business Regulations

This section is intended to provide a general awareness of beauty salons regulations and agencies to consider when starting a beauty salon business. Check with you state and municipality for rules and regulations that may impact the business in your area.

- Hair Salons: Facts about Formaldehyde in Hair Products – Occupational Safety and Health Administration

- Salon Professionals: Fact Sheet – U.S. Food & Drug Administration’s resources about the safety of cosmetic products used in beauty salons.

- Protecting the Health of Nail Salon Workers – A guide promoting safe and healthy practices for salons.

Salon & Related Business Publications

Beauty Salon Business Associations

Trade associations often are excellent sources of information on an industry. Here are some relevant beauty salon industry associations:

- American Association of Cosmetology Schools

- Professional Beauty Association

- Salon Spa Professional Association

- Associated Skin Care Professionals

- Associated Nail Professionals

- The Day Spa Association

- American Association of Cosmetology Schools

Beauty Salon Business Employment Trends

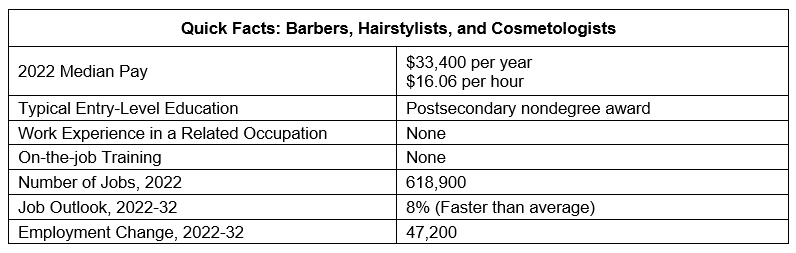

Understanding trends in your industry is important when opening a new beauty salon. Salons encompasses a variety of jobs, the following are insights from the Bureau of Labor Statistics into one of the main occupations, barber, hairstylist, and cosmetologist. A more specific breakdown of other beauty salon occupations is available from the Bureau of Labor Statistics.

- “The median hourly wage for barbers was $16.82 in May 2022. The median wage is the wage at which half the workers in an occupation earned more than that amount and half earned less. The lowest 10 percent earned less than $11.00, and the highest 10 percent earned more than $29.29. The median hourly wage for hairdressers, hairstylists, and cosmetologists was $16.01 in May 2022. The lowest 10 percent earned less than $10.48, and the highest 10 percent earned more than $28.88.

- Work Environment: Barbers, hairdressers, and cosmetologists held about 766,100 jobs in 2018. 75% of barbers were self-employed; nearly half of all hairdressers, hairstylists, and cosmetologists were self-employed.

Employment in the detailed occupations that make up barbers, hairdressers, and cosmetologists was distributed as follows:- Hairdressers, hairstylists, and cosmetologists: 683,800

- Barbers: 82,300

- Job Outlook: Overall employment of barbers, hairstylists, and cosmetologists is projected to grow 8 percent from 2022 to 2032, faster than the average for all occupations.

About 89,400 openings for barbers, hairstylists, and cosmetologists are projected each year, on average, over the decade. Many of those openings are expected to result from the need to replace workers who transfer to different occupations or exit the labor force, such as to retire.

The need for barbers and hairdressers will stem primarily from demand for basic hair care services. In addition, an increased demand for hair coloring, hair straightening, and other advanced hair treatments is expected to continue over the projection’s decade.

Hairdressers, hairstylists, and cosmetologists will continue to compete with providers of specialized services, such as nail and skin care. Consumers often choose manicurists and pedicurists and skincare specialists for these services, rather than to visit hairdressers, hairstylists, and cosmetologists for them. Still, employment is expected to grow to meet increased demand for personal appearance services.”

Additional Resources

Already in business or thinking about starting your own small business? Check out our various small business resources:

- View more business reports here: Small Business Snapshots

- View small business help topics here: Small Business Information Center

- View industry-specific research here: Market Research Links

- View business plans samples here: Sample Business Plans

Remember, you can also receive free professional business advice and free or low-cost business training from your local Small Business Development Center!